About 'accounting software services'|Peter Thiel And Existing Investors Put Another $49 Million In Accounting Software Company Xero

Accounting for Cleaning Service If you are like me accounting isn't your strong suit. At first I was quite intimidated and didn't know what to do. I gave my customers a receipt from a receipt book, used only my business checking account and hung onto all of my receipts for equipment and supplies which I continued to do. A couple of months into my new business, I really needed to figure out an accounting system. As luck would have it one of my customers was a freelance bookkeeper. I asked her for advice, and she helped me out tremendously. First she got me a copy of QuickBooks, and then she helped me to set it up. Since I had waited a few weeks to set up an accounting system, it was a bit more complicated. She helped me in exchange for a cleaning discount. If you aren't as lucky in finding a bookkeeper for a customer, having someone set up your bookkeeping isn't prohibitively expensive. Quicken comes with help screens and tutorials that make running your business fairly easy even with only a rudimentary understanding of accounting. I definitely recommend using some type of computerized accounting software or a professional bookkeeper. Keeping accounting books by hand is hard and time-consuming. Business Checking Account All I needed to open a business account at the bank where my personal account was located was a copy of my trade name registration and ID. Only use your business account for business transactions and your personal account for personal transactions. Doing this will keep your accounting cleaner and easier for records and tax purposes. It also looks fishy to the IRS if you don't. Basic Accounting Accounting is like a continual scale in which both sides must balance. Debits and credits are the weights, and every ledger entry has an equal debit and credit side. Doing accounting by hand would have been a nightmare for me; and QuickBooks as well as most other accounting software either does this for you went entering income or receipts or at least helps you to do this. Balance sheets are composed of your assets and liabilities. Assets are what you own such as your cleaning equipment and cash in the bank. Liabilities are what you owe such as small business loan payments. Owner's equity is simply your assets minus your liabilities. At the end of the year your income is netted against your expense accounts giving you your profit or loss for the year. Any retained profit becomes owner's equity and your balance sheet is zeroed out. So a balance sheet is where you are today and an income sheet is a sum from the beginning of your fiscal year. A Profit and Loss Statement or Income Statement is a quarterly or annual fiscal report showing the net profit or loss during the period of time state in the report. It is used for tax purposes and to see how a company performed during a period of time. You may want to separate your income accounts into types such as one-time cleanings, weekly cleanings, etc. over time knowing what services bring in more money can help you decide on what services you will or won't provide in the future. Expense accounts include things like cleaning supplies, office supplies, telephone bill, interest, rent, utilities, etc. keeping track of your expenses is vital to the health of your business. Because I finally took the time to set up an accurate accounting system, I was able to determine the cost difference between using the customer's cleaning supplies and using my own which caused me to slightly raise my rates when using my own supplies. It also showed me that using coupons and stocking up during sales was extremely cost effective. |

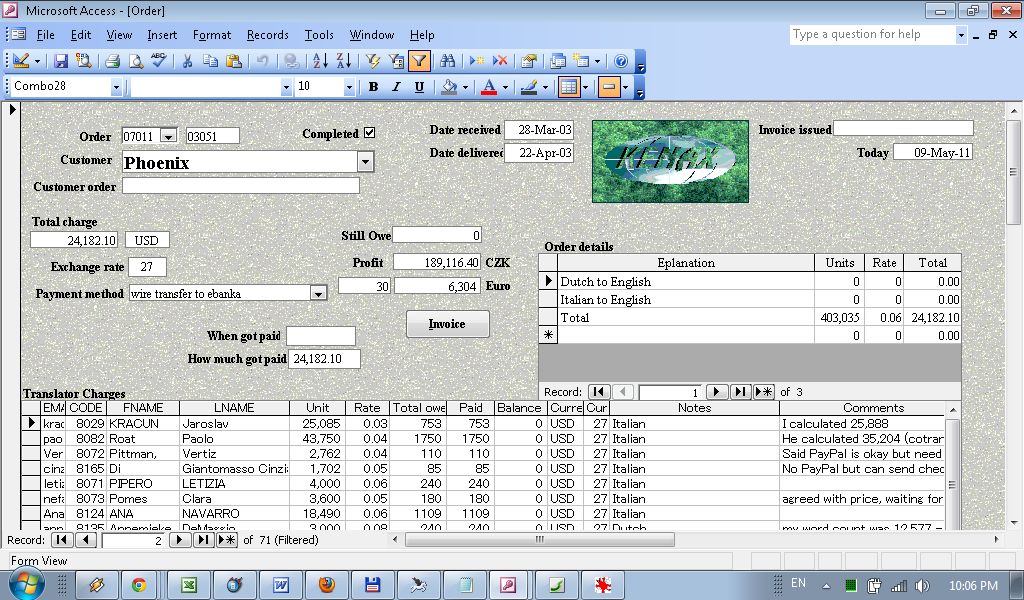

Image of accounting software services

Related blog with accounting software services

- washlessons.wordpress.com/...Capacity Building for Municipal Service Delivery in Kerala” (2006-2008) ...and implemented municipal accounting software in five municipal corporations...

- salescareers.wordpress.com/...Our client is seeking an Account Executive who meets the following... with entire lifecycle of the sale (software sales experience preferred) Able...

- techcrunch.com...July 1, 2006 Funding: $244M Xero provides online accounting software and services for small and medium businesses. It includes a...

- mpetrelis.blogspot.com/...accounting software which will allow...the whole set of accounts together with the...Ali, I do not join services like this, unless the...

- wilkencpas.wordpress.com/...to go the “cloud computing” route and purchase an on-line accounting software service. Cloud versions of traditional accounting software systems...

- businessguides.wordpress.com/...of change in the accounting software industry over the...the company’s service can all be ...off within a year. Accounting software is ...

- globalsparks.blogspot.com/...use the accounting services then being a business...give the extra attention for your accounting system. Software can help you in a ...

- techcrunch.com...July 1, 2006 Funding: $244M Xero provides online accounting software and services for small and medium businesses. It includes a...

- ibloga.blogspot.com/...Surf Control (the two largest companies that make web blocking software)that Jihad Watch, IBA, and others are news sites not "hate", or...

- ivythesis.typepad.com/...inventory turnover and robust cash assets. There are software service companies such as The Accounting Library that promises cheap AIS without the need to...

Accounting Software Services - Blog Homepage Results

Related Video with accounting software services

accounting software services Video 1

accounting software services Video 2

accounting software services Video 3